What Happens When Internal Audit Is Ignored? It Happens Too Often

August 26, 2019

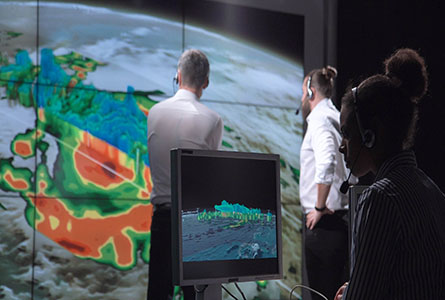

6 Risk Management Lessons I Learned From Hurricane Dorian

September 9, 2019Two significant developments in business took place at the end of August that could have profound and long-lasting impacts on how organizations operate. Internal auditors should take note.

First, the Business Roundtable, an association of leading U.S. CEOs, announced a fundamental change to its Statement on the Purpose of a Corporation. The statement, which is updated periodically, is the de facto marching orders for doing business in America and, for the past 20 years, has been pretty basic: Serve the shareholder.

The second development relates to lawsuits stemming from the ongoing opioid epidemic in the United States. Two major pharmaceutical companies face costly judgments and settlements for their role in the crisis.

According to the U.S. National Institute on Drug Abuse (NIDA), more than 47,000 Americans died in 2017 as a result of an opioid overdose, including prescription opioids, heroin, and illicitly manufactured fentanyl, a powerful synthetic opioid. Manufacturers of prescription opioid pain relievers face thousands of lawsuits relating to how these drugs contributed to the epidemic. According to NIDA:

In the late 1990s, pharmaceutical companies reassured the medical community that patients would not become addicted to prescription opioid pain relievers, and health-care providers began to prescribe them at greater rates. This subsequently led to widespread diversion and misuse of these medications before it became clear that these medications could indeed be highly addictive.

So, how do these two developments relate to each other? The simple answer is social accountability.

Last month, a judge in Oklahoma ordered Johnson & Johnson, a multinational consumer products and pharmaceutical company, to pay $572 million for contributing to the state’s opioid-addiction crisis. The Oklahoma case is the first of more than 2,000 against drug manufacturers, retail pharmacy chains, and distributors to go to trial.

The potential judgments and settlement costs major pharmaceutical companies face — potentially in the billions of dollars — are clearly linked to their products. While none of the companies has admitted to any illicit or illegal activity relating to its manufacture and marketing of prescription opioids, they are nonetheless being held accountable by the courts and the general public. Holding corporations accountable is not new. Courts all over the world have done so, from the Union Carbide disaster in Bhopal, India, to faulty airbags involving Takata.

But efforts to hold pharmaceutical companies accountable for their role in the opioid epidemic goes beyond simple accountability and product liability. There is an important added component: the public good.

One definition of social accountability offers clarity on this point. It refers to social accountability as “the actions initiated by citizen groups to hold public officials, politicians, and service providers to account for their conduct and performance in terms of delivering services, improving people’s welfare, and protecting people’s rights.”

This is where the Business Roundtable’s new Statement on the Purpose of a Corporation comes in.

First, a little background. The Business Roundtable is one of the most powerful and influential business groups in the U.S., if not the world. The Washington, D.C.-based nonprofit comprises CEOs of major U.S. companies such as Amazon, Apple, and General Motors. It promotes public policy that’s favorable to business interests.

The update to the Statement on the Purpose of a Corporation elevates the interests of employees, customers, suppliers, and communities to the same level as shareholders. While not abandoning the core directive to serve shareholder needs, the statement clearly introduces a social accountability component that can be safely described as profound and significant.

The statement is full of key words and phrases that embrace and promote social accountability: “investing in our employees,” “dealing fairly and ethically with our suppliers,” “respect the people in our communities,” ” protect the environment,” “embracing sustainable practices.”

The 181 signatories to the statement are leaders of some of the world’s largest and most influential corporations, which should lend it credence, credibility, and gravitas. However, critics are quick to point out that some of the signatories already run afoul of the statement’s lofty rhetoric.

For internal audit, there are ethical, cultural, and business strategy implications that should direct how CAEs address this new approach to doing business. The first step will be to establish how your particular organization responds to the new statement. Are executive management and the board committed to operating the organization in a socially responsible way? Does your organization’s culture embrace social responsibility?

Many organizations already have sustainability and social responsibility policies in place, such as providing employees time off to volunteer in their communities. These practices and policies can be easily audited. The bigger challenge will be addressing whether other aspects of the organization, such as executive compensation, supply chains, use of natural resources, and employee programs, live up to social responsibility standards.

As always, I look forward to your comments.

I welcome your comments via LinkedIn or Twitter (@rfchambers).